Introduction

Interest rate news plays a major role in our daily financial lives, even if we do not notice it directly. Whenever banks change loan rates or governments announce new economic policies, interest rate news is usually behind those decisions. For beginners and intermediate readers, understanding this topic can feel confusing at first. However, once explained in simple terms, it becomes much easier to follow and apply in real life.

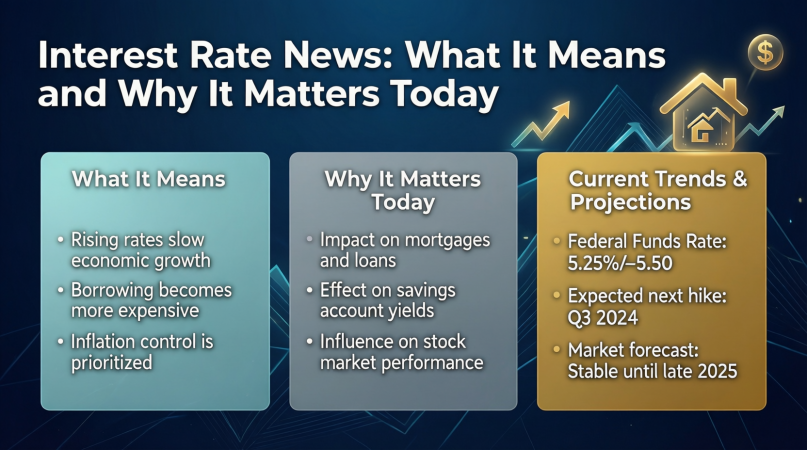

In recent years, interest rate news has gained more attention because it affects savings, loans, inflation, and overall economic growth. When interest rates go up or down, people feel the impact on home loans, car financing, business investments, and even job opportunities. That is why many individuals now follow interest rate news regularly to make smarter money choices.

This article is written to help you clearly understand interest rate news without complex language. You will learn what it means, why it is important, how to read and interpret updates, and how it affects your personal finances. Step by step, we will break down the process so you can follow financial updates with confidence.

By the end of this guide, you will have a strong foundation to understand interest rate news and use it to plan better financial decisions. Whether you are saving money, planning a loan, or simply staying informed, this article will help you stay ahead.

What is Interest Rate News?

Interest rate news refers to updates and announcements related to changes in interest rates set by central banks or financial institutions. These updates explain whether rates are increasing, decreasing, or staying the same.

Interest rates are the cost of borrowing money or the reward for saving money. When you take a loan, you pay interest. When you save money in a bank, you earn interest. Interest rate news tells us how these rates are changing.

Usually, central banks release interest rate news after reviewing economic conditions like inflation, employment, and growth. These announcements are closely watched by banks, investors, businesses, and regular consumers.

In simple words, interest rate news is financial information that helps people understand the direction of the economy and plan their money decisions accordingly.

Why is Interest Rate News Important?

Interest rate news is important because it affects almost every part of the economy. From personal budgets to large business investments, interest rates play a key role.

When interest rates rise, borrowing becomes more expensive. This can slow down spending and reduce inflation. On the other hand, when rates fall, borrowing becomes cheaper, encouraging spending and investment.

For individuals, interest rate news helps in deciding when to take loans or invest savings. For businesses, it guides expansion and hiring plans. Governments also use interest rate changes to manage economic stability.

Because of these wide effects, interest rate news is considered a powerful economic signal that should not be ignored.

Detailed Step-by-Step Guide

Step 1: Understand Who Sets Interest Rates

Interest rates are mainly set by central banks. These institutions control monetary policy to keep the economy stable.

Central banks review economic data before making decisions. Their goal is usually to control inflation and support growth.

Step 2: Follow Official Announcements

Interest rate news is released during scheduled policy meetings. These announcements explain the decision and future expectations.

Reading summaries instead of technical reports can help beginners understand the message easily.

Step 3: Watch Market Reactions

After interest rate news is released, markets react quickly. Stock prices, currency values, and bond markets often change.

Observing these reactions helps you understand how important the news is.

Step 4: Connect News to Your Finances

Interest rate news should be linked to your personal situation. Loan payments, savings returns, and investment plans may all be affected.

For example, rising rates may increase loan costs but improve savings returns.

Step 5: Adjust Financial Plans Accordingly

Once you understand the impact, adjust your budget or investments. This step helps you stay financially prepared.

Small changes based on interest rate news can make a big difference over time.

Benefits of Interest Rate News

- Helps individuals make informed borrowing decisions

- Guides savings and investment strategies

- Supports better financial planning

- Improves understanding of economic trends

- Helps businesses plan growth and expenses

- Reduces financial uncertainty

Disadvantages / Risks

- Misinterpretation can lead to poor decisions

- Frequent changes may create confusion

- Short term market reactions can be misleading

- Emotional responses may cause financial mistakes

- Overreliance on news without context

Common Mistakes to Avoid

Many people make mistakes when following interest rate news. One common mistake is reacting too quickly without understanding the full message. Headlines can be misleading if read alone.

Another mistake is ignoring long term trends. Interest rate news should be viewed over time, not as a single event.

Some people also assume that rate changes affect everyone equally. In reality, the impact depends on personal financial situations.

Avoid panic decisions and always connect interest rate news to your own goals.

FAQs

What does interest rate news mean for loans?

Interest rate news affects loan costs. When rates rise, loan payments increase. When rates fall, borrowing becomes cheaper.

How often is interest rate news announced?

Most central banks announce interest rate news several times a year during scheduled meetings.

Does interest rate news affect savings accounts?

Yes, savings interest rates often change based on interest rate news. Higher rates usually mean better returns.

Can interest rate news impact inflation?

Interest rate news is closely linked to inflation control. Higher rates can reduce inflation, while lower rates may increase it.

Should beginners follow interest rate news regularly?

Yes, beginners can benefit from following simplified interest rate news to build financial awareness.

Is interest rate news the same worldwide?

No, interest rate news varies by country because each economy has different conditions and policies.

Expert Tips & Bonus Points

Experts suggest focusing on trends instead of daily updates. This approach reduces stress and improves decision making.

It is also helpful to compare interest rate news with personal financial goals. This makes the information more useful.

Keeping a simple financial journal can help track how interest rate changes affect your expenses and savings.

Finally, always seek clarity instead of reacting emotionally to sudden news.

Conclusion

Interest rate news is a powerful tool that helps individuals, businesses, and governments understand economic direction. While it may seem complex at first, learning the basics can greatly improve financial confidence. By understanding what interest rate news is and why it matters, you can make smarter decisions about borrowing, saving, and investing.

Throughout this article, we explored how interest rate news works, its benefits, risks, and common mistakes to avoid. We also answered key questions and shared expert tips to help you stay informed without feeling overwhelmed. The goal is not to predict every change, but to stay prepared and informed.

As you continue learning, remember that interest rate news should support your long term financial goals. Use it as guidance rather than a reason for fear or excitement. With a calm and informed approach, interest rate news can become a valuable part of your financial journey.